tax sheltered annuity vs 401k

Although 401k plans are the most popular an alternative known as a tax-sheltered annuity or TSA plan is available to many workers especially in the nonprofit world. You only pay taxes on the growth when you remove the funds.

How To Roll Your Ira Or 401 K Into An Annuity

Here is the complete annuity formula to understand the.

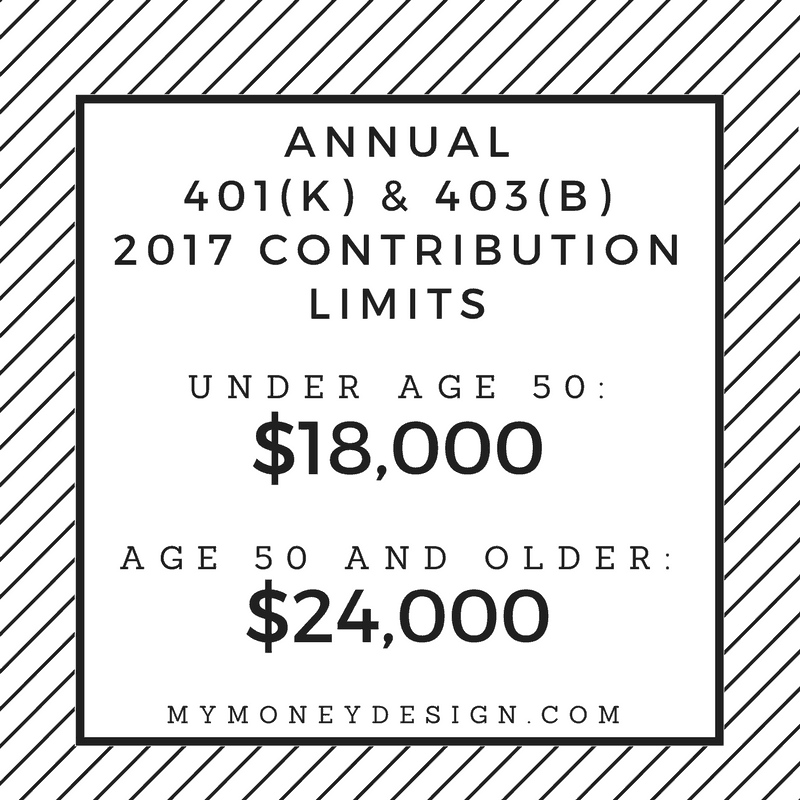

. A tax-sheltered annuityalso known as a 403 b plan or a TSA planis a type of retirement plan only offered by certain 501 c 3 tax-exempt organizations such as charities. If youre used to a 401 k you might already be aware that the 19500 limit for 2021 applies only to employee contributions. The major difference between annuities and 401 k plans is that with an annuity the individual invests hisher own money while a 401 k comes from an employment source.

Both annuities and 401 ks provide a tax-sheltered way to save for retirement. These plans tend to be offered by public schools and some nonprofits. You will not owe income taxes on the investment returns of a 401 k or annuity until you.

A tax-sheltered annuity plan gives employees the option to defer some of their salaries into tax-deferred investment accounts. A tax-sheltered investment is an asset or a portfolio of assets that is purchased or structured to reduce your income tax liabilities in a legal way. An annuity is an investment vehicle with tax-deferred growth.

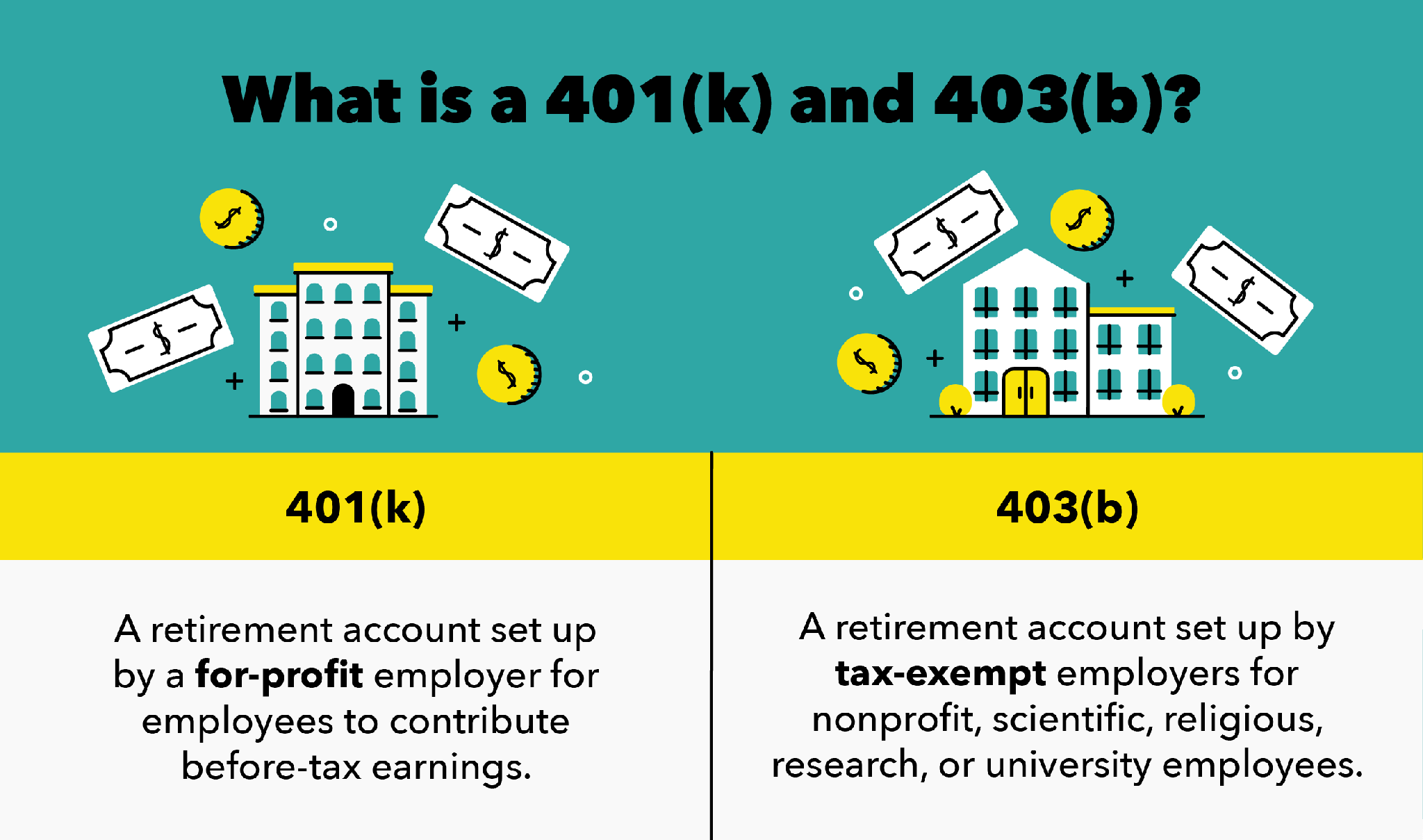

Contribution limits for a 403b. The employee will not pay any taxes on their. According to the IRS a 403 b plan or tax-sheltered annuity TSA differs from a 401 k in that it can only be offered by public schools and certain tax-exempt organizations.

A Roth IRA is a retirement plan. Once also known as. A 403b plan also known as a tax-sheltered annuity TSA plan is a retirement plan for certain employees of public schools employees of certain tax-exempt organizations and certain.

A 403 b plan also called a tax-sheltered annuity or TSA plan is a retirement plan offered by public schools and certain 501 c 3 tax-exempt organizations. A 403b plan is also known as a tax-sheltered annuity or TSA plan. Another historical difference between 403 b and 401 k plans lies in the investment options each offer although that distinction lessens over time.

This was despite annuity products remaining the most popular option among tax-sheltered annuity plan participants. A 403 b plan also called a tax-sheltered annuity or TSA plan is a retirement plan offered by public schools and certain 501 c 3 tax-exempt organizations. For 401 k plans the total contribution limit.

403 B Vs 401 K What S The Difference How Are They The Same

:max_bytes(150000):strip_icc()/GettyImages-184873146-574748093df78c6bb088a35b.jpg)

401 K And 403 B Plans What S The Difference

Why The Median 401 K Retirement Balance By Age Is Dangerously Low

403 B Plan How It Works And Pros Cons The Motley Fool

A 401 K Vs An Ira For A Sixty Year Old

What S The Difference Between 401 K And 403 B Retirement Plans

Annuity Vs 401 K Which Is Better

The 401k Vs 403b Plan Find The Legal Difference Between Cc

403b Vs 401k What S The Difference

Annuity Vs 401 K Which Is Better For Retirement Smartasset

Annuity Vs 401k Comparing The Risk And Benefits

403b Vs 401k Plans What S Better For Retirement Walletgenius

Difference Between 401k And 403b Retirement Plans

403 B Vs 401 K Complete Retirement Plans Comparison Recommendations

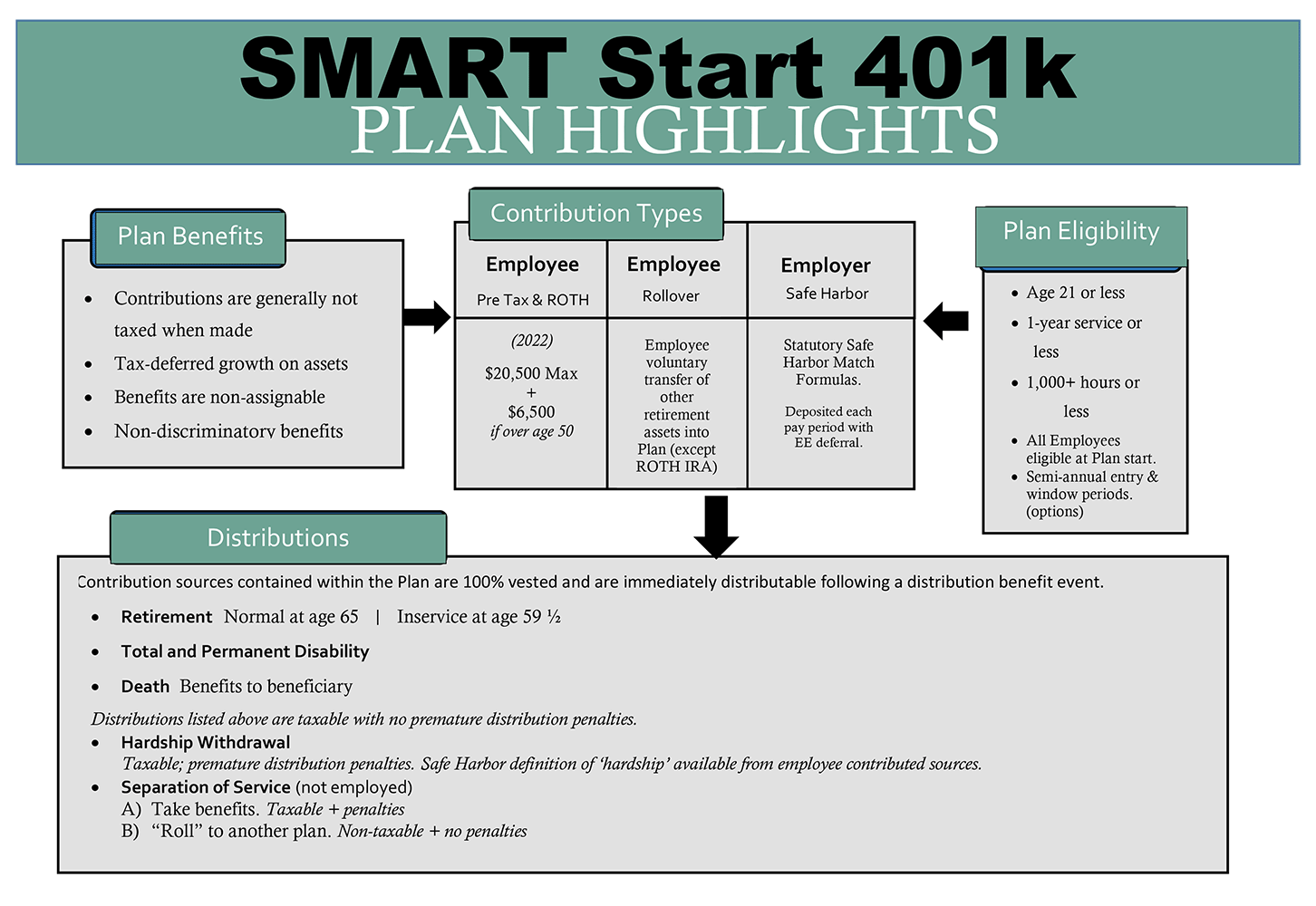

Financial Professionals Nexus Administrators

401 K Vs 403b Chapter 7 What Is A 403b Vs 401 K Intuit Mint

Tax Sheltered Annuity Faqs Employee Benefits